What is Invoice Financing? Know How it Works, Types and Differences

- 12 Nov 25

- 8 mins

What is Invoice Financing? Know How it Works, Types and Differences

Key Takeaways

- What is invoice financing? It is a funding method where businesses borrow money against their unpaid invoices to improve cash flow without using physical collateral.

- It involves submitting invoices to a lender, receiving up to 70–90% of their value as an advance, and repaying once the client pays.

- The two main types of invoice financing are invoice factoring (where the lender collects payments) and invoice discounting (where the business retains control).

- It offers quick, collateral-free funding that boosts liquidity, maintains business ownership, and reduces dependency on traditional loans.

- Higher costs, possible customer relationship risks, and limited long-term sustainability can be challenges of invoice financing.

In recent years, businesses have been increasingly using invoice financing to access immediate funding without requiring any collateral. The fact is evident from a report uploaded by RXIL, a TReDS portal, which claims to have already crossed the ₹2 lakh crore milestone in MSME invoice financing orders.

However, many business owners might still be unaware of what is invoice financing, owing to a lack of awareness on payment terms. Let us have a thorough discussion regarding its implementation in this blog.

How Invoice Financing Works in Real Life?

India's accounts receivable financing market, encompassing both invoice factoring and discounting, reached $133.3 billion by the end of last year. Moreover, current projections suggest a CAGR of 5.3%, which will result in this industry reaching $212.2 billion by 2033.

Businesses that require an immediate cash flow can use invoice finance like this:

Step 1: Provide Your Invoice Particulars to the Chosen Lender

First, you must submit the invoice against which you wish to avail a loan. It must correspond to supplies that your business has delivered before. Additionally, the invoice must mention the due date of payment.

Step 2: Your Lender's Finances After Checking the Details

Upon a successful approval, your lender gives you a certain percentage of the presented invoice amount as an advance. Normally, this value can reach up to 70-90% of your bill amount. Availing this benefit can help you manage overhead and operational expenses promptly, without waiting for outstanding bill payments.

Step 3: You Collect the Outstanding Payments

After getting the financial aid from your lender, you continue to collect the outstanding amounts from your clients. While doing this, you make sure that they pay you in full.

Step 4: You Repay the Lender

After your invoice amount is cleared, you repay the owed amount to your lender. This will include some interest rate or charges that will be agreed upon between both parties upfront.

What are the Various Types of Invoice Financing?

Being a company owner, you can choose between invoice factoring or discounting for easy access to emergency funds. Both of these methods are slightly different.

- Invoice Factoring

Also known as debt factoring, this method of financing works on the idea of selling your unpaid invoices to a different company. In return, that lender purchases your unsettled bills for a fixed percentage of the total value and assumes the responsibility of collecting payments directly from your customers. Despite its easy accessibility, factoring has been underutilised with a limited market penetration of merely 5-10%.

2. Invoice Discounting

The discounting method is more secretive, as your customers have no idea that you are using the unsettled bills to generate a steady cash flow. Unlike the method discussed before, here your business is in complete control of maintaining all the sales records. As a result, you are responsible for collecting the remaining money from the customers.

Irrespective of the method you select, invoice financing can offer you up to 3 times more cash flow compared to other loan types. Overall, it helps quicker processing of invoices and allows you to maintain better relationships with the customers.

Difference Between Invoice Factoring and Invoice Discounting

To fully understand what is invoice financing, it is essential to know how its types differ from each other. Having said that, there are two fundamental differences:

| Parameter | Invoice Factoring | Invoice Discounting |

|---|---|---|

| Invoice Collection Responsibilities | Your lender manages your sales ledger and takes timely follow-ups from the customers to collect outstanding payments. | The invoice financing arrangement remains confidential, and you collect the pending payment terms from your customers. |

| Fund Disbursement | The borrower receives advance funds against each invoice, which accommodates daily adjustments. | Fund disbursements occur monthly after the borrower provides their invoice particulars. |

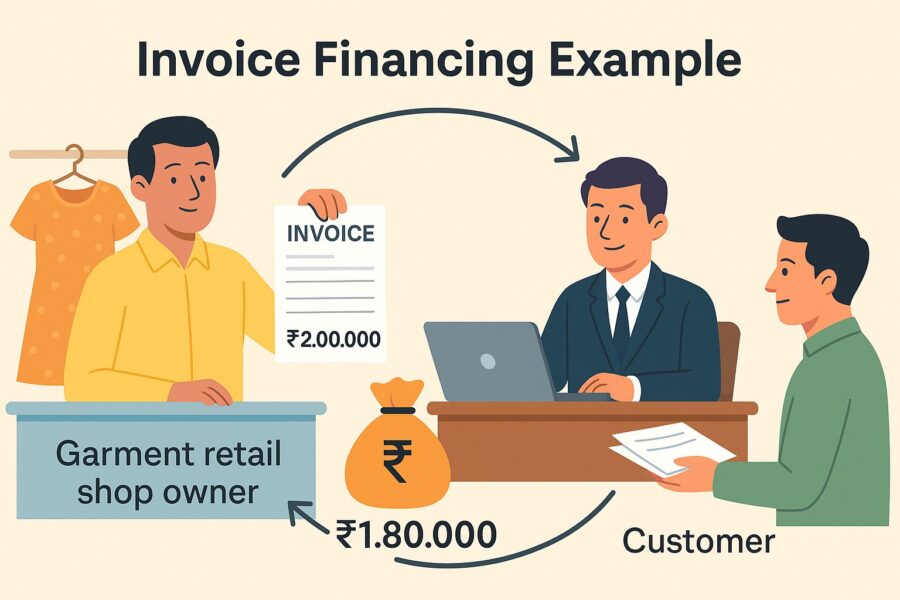

Invoice Financing Example

Below, you can go through a hypothetical scenario to better understand how invoice financing actually works practically.

Let us assume that Ravi, a garment retail shop owner, decides to finance an invoice of ₹2 lakhs with 30-day terms. For this, he must submit the particular invoice to his lender.

Now, upon receiving his request, the lending company approves to provide a 90% advance of the invoice amount, i.e., 1.8 Lakhs. In return, they will charge a 2% weekly fee on any outstanding balance. For example, if Ravi’s customer pays in three weeks, he will owe an extra ₹4,000 (2% of ₹2,00,000) per week to the lender.

After the customer pays, the financing company will keep its share, and any remaining balance will be returned to the borrower.

What are the Pros and Cons of Invoice Financing?

Invoice financing enables businesses to access immediate cash by borrowing against outstanding invoices, offering several advantages and some notable drawbacks.

Pros of Invoice Financing

- Improved Cash Flow: Businesses receive up to 70-90% of invoice value upfront, ensuring liquidity to meet operational expenses, payroll, and growth needs without waiting for customer payments.

- Quick and Flexible Funding: Funds can be accessed rapidly, often within 24-48 hours and drawn as needed, providing flexibility to manage short-term needs or seize new opportunities.

- No Collateral Required: Approval is based on the creditworthiness of customers, not the business’s assets or credit history, making it accessible for startups or those lacking substantial collateral.

- Maintains Business Ownership: Unlike equity financing, invoice financing does not dilute ownership or control. For invoice financing, the business retains control over customer relationships and collections.

- Reduced Paperwork: The process is typically straightforward, requiring less documentation than traditional loans.

Cons of Invoice Financing

- Cost of Borrowing: Fees can range from 1% to 6% of the invoice value, making it more expensive than some traditional financing options. Frequent use can erode profit margins.

- Potential Loss of Customer Relationship Control: In invoice factoring, the finance company takes over collections, which may affect customer relationships if handled aggressively.

- Credit Impact: Extensive use may impact your business’s credit rating, as lenders can file liens on receivables.

- Short-Term Solution: Invoice financing addresses immediate cash flow issues but is not a long-term fix for fundamental business problems.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

How to Apply for Invoice Financing?

You can follow the instructions given below to get your business’s invoice financing done:

Step 1: Check Your Eligibility

You should ensure that most of your customers have good creditworthiness before you opt for invoice factoring or discounting. Although getting timely payments from the customers is the key in invoice financing, the lender will still assess your credit history before approving any borrowing request.

Step 2: Research and Compare Lenders

Lending institutions are typically assessed based on the loan limits offered, funding speed, and overall market reputation. Additionally, you should ensure that your preferred lender has dedicated customer support for prompt resolutions.

Step 3: Fill Out the Application

When completing the application, you will be asked to provide:

- Business and personal information

- Recent bank statements and income tax returns

- Invoices that need to be financed

- Several statements like the accounts receivable ageing report

- Your personal and business credit score

For other application-related details, you should check out the official website of your lender.

Conclusion

Understanding what is invoice financing is not as complex as it might seem. At its core, this financing method allows businesses to unlock funds tied up in unpaid invoices. To become eligible for invoice financing, you typically need a set of unsettled invoices and a customer base known for making timely payments.

If both these conditions are met, you can explore invoice factoring or invoice discounting as viable options. These methods provide immediate access to working capital, which can significantly improve your cash flow, reduce dependency on traditional loans, and help manage operational expenses more efficiently and strategically.